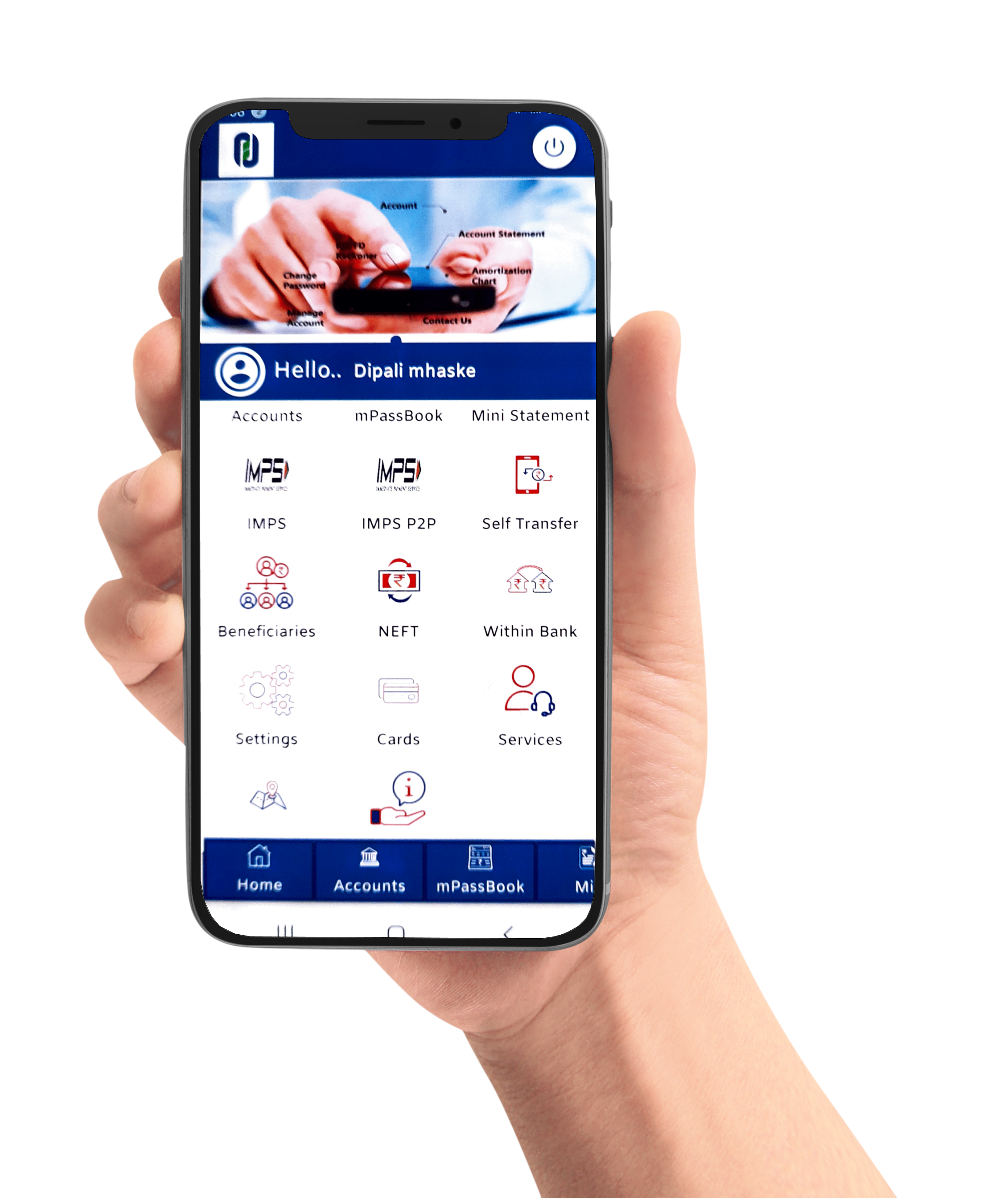

Non-Financial Transactions

- Account Balance: Check your balance anytime, anywhere.

- Mini Statement: Get a quick overview of recent transactions.

Financial Transactions

- Instant Fund Transfer: Transfer up to ₹5 lakh instantly!

- Within Bank: Send money to other accounts within the bank.

- Transfer to Mobile Phone: Easy transfers directly to mobile numbers.

- Transfer to Account: Seamless transfers to any bank account.

Login and Transaction Details

- Login in to Mobile App with PIN Security (Android User)

- Account Balance Inquiry

- Mini Statement Last 10 transactions.

- Transaction Limit Rs.5, 00,000/-Per day.

Financial transaction as follows:

- Fund Transfer (Instant fund transfer up to 5 lakh, 24x7)

- Transfers to within bank.

- Transfers to Mobile Phone, P2P (Person to Person) or Transfers to Account, P2A (Person to Account).

Documentation

- Download "Pune People's Mobile Banking" Mobile app from Play Store.

- Register your Mobile number with your bank account.

- Register for Mobile banking.

- Get Security code from Home Branch.

- Generate PIN for Mobile Banking Application.

IMPS

- IMPS Branch Debit (Instant fund transfer up to 5 lakh) P2P (Person to Person) P2A (Person to Account)

- IMPS stands for Immediate Payment Service. It's a real-time interbank electronic payment system in India that enables users to transfer money instantly between bank accounts, 24/7.

IMPS Features

- Instant Transfers: Real-time money transfer.

- 24/7 Availability: Accessible any time, including holidays.

- Multiple Channels: Use mobile apps, SMS, or online banking.

- Interbank Transactions: Works between different banks.

- Low Cost: Affordable transaction fees.

- Secure: Uses secure channels for safety.

- Wide Reach: Supports many banks in India.

- Ideal for Small Payments: Great for quick, small transactions.

IMPS

How to Use:

- Log In: Access your account through the banking app.

- Select Transfer Option: Choose IMPS from the menu.

- Enter Details: Fill in the recipient’s bank account details, including name, account number, and IFSC code.

- Specify Amount: Enter the amount you wish to transfer.

- Review and Confirm: Double-check the details before confirming the transaction.

- Complete Transfer:Submit your request and receive a confirmation.

Terms and Conditions

- • Terms and Conditions for Mobile Banking Application View PDF

Frequently Asked Questions

What are services available on mobile banking?

Pune Peoples Bank's Mobile banking Facility provides complete banking solution with various services like Balance Enquiry, Mini Account Statements, Funds Transfer (NEFT/RTGS/IMPS), Apply for Cheque Book. Locate bank branches & nearby ATM’s, Manage beneficiaries, multiple A/c has, Etc.

Is PPCO Mobile Banking free? Are there any hidden charges?

PPCO Mobile Banking is totally free. There are no charges for

sending money to other bank accounts. All transactions executed on

the PPCO Mobile Banking app are free of cost. There are no hidden

charges to be worried for.

How to Register to PPCO Mobile Banking?

To register PPCO Mobile Banking, download Mobile Banking

application, register with mobile number & Customer ID. And by

entering your Security Code (Registered PAN NO.) & generate MPIN

(Mobile PIN) after that Generate TPIN (Transaction PIN)

What is my Customer ID? Or Where I can find my Customer ID? Or I forgot my Customer ID?

Your customer ID will be printed on the first page of your

passbook as Customer Number.

I forgot my MPIN (Login Pin) for PPCO Mobile Banking? Or How to generate MPIN for Pune Peoples Bank account?

To generate the MPIN for PPCO Mobile Banking, please follow the steps :

- On Login screen, select ‘Register Now /Forgot Pin’

- On Next screen, accept the terms & conditions by selecting tick mark & select Next Button

- Enter your Customer ID

- Select the option of Debit card

- Enter Debit card details accordingly

- Re-register yourself & set new MPIN & TPIN

To set your MPIN, it is mandatory to follow the above steps.

How many accounts can I link to the Mobile Banking Application?

You can link multiple accounts under the same customer ID to the

Mobile Banking Application. This allows you to manage all your accounts

(savings, fixed deposits, etc.) from one app. If your accounts

have different customer IDs, you may need to register separately

or visit your nearest branch for assistance in consolidating them.

What are the benefits of IMPS?

- Instant

- Available 24 x7 (functional even on holidays)

- Safe and secure, easily accessible and cost effective

- Channel Independent can be initiated from Mobile/ Internet / ATM channels

- Debit & Credit Confirmation by SMS

What is limit for IMPS?

The per transaction limit on IMPS is Rs. 5 lakh (for all channels

except SMS and IVR). For more details, pls contact your bank

What details are required for an IMPS transaction?

You’ll need one of the following combinations:

- Account Number and IFSC Code of the recipient.

- Mobile Number and MMID (Mobile Money Identifier) of the recipient.

- Aadhaar Number(if supported).

What is MMID in IMPS?

Mobile Money Identifier is a 7 digit number, issued by banks. MMID

is one of the input which when clubbed with mobile number

facilitates fund transfer. Combination of Mobile no. & MMID is

uniquely linked with an Account number and helps in identifying

the beneficiary details. Different MMID’s can be linked to same

Mobile Number. (Please contact your bank for getting the MMID

issued)

Is the facility of Stop payments is available on IMPS?

No, IMPS is an immediate fund transfer service, after initiating

the payment request payment cannot be stopped or cancelled.

Can I cancel an IMPS transaction after it is initiated?

No, IMPS transactions are processed in real-time and cannot be

cancelled once initiated. Please double-check the details before

confirming the transaction.

What are the timings for initiating and receiving IMPS remittances?

IMPS transactions can be sent and received 24X7, (round the

clock), including on holidays.

Can I use IMPS for international transfers?

No, IMPS is only for domestic fund transfers within India.

What should I do if an IMPS transaction fails?

If your IMPS transaction fails, but the amount is debited from

your account:

- Wait for 24 hours as the amount may be auto-refunded.

- If not refunded, contact customer support with the transaction reference number.

Are there any charges for IMPS transactions?

No charges are applicable, no hidden charges.